Loan Planning & Solution

Loan planning is crucial for achieving your financial goals without overburdening your finances. Our Loan Planning & Solution services offer personalized guidance to help you choose the right loan product, tailored to your needs. We analyze your financial situation, assess repayment capacity, and recommend the best loan options with competitive rates.

Client Background

Our client, a rapidly growing small business specializing in eco-friendly products, had been operating successfully for three years. With a strong commitment to sustainability and innovation, the business had established a loyal customer base. However, to meet increasing demand and expand their product line, they needed additional financial support. Despite their success, the client faced challenges in securing the necessary funding due to limited credit history and fluctuating cash flow. Determined to continue their growth trajectory.

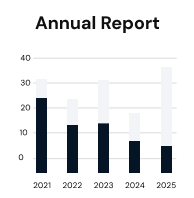

Statistics Results

Our client, a rapidly growing small business specializing in eco-friendly products, had been operating successfully for three years. With a strong commitment to sustainability and innovation, the business had established a loyal customer base. However, to meet increasing demand and expand their product line, they needed additional financial. Our client, a rapidly growing small business specializing in eco-friendly products, had been operating successfully for three years.

Challenges

- Budget Constraints: Sarah and James needed to ensure that the loan amount would be sufficient to cover all wedding expenses without exceeding their repayment capacity.

- Time Sensitivity: With the wedding date approaching, the couple required a quick and efficient loan approval process.

- Credit Score: Both clients had good credit scores, but they were keen on finding a lender who would offer favorable terms based on their financial history.

Project Success Key

Our wedding loan services were perfectly suited to meet Sarah and James’s needs. Here’s how we addressed their challenges:

- Initial Consultation: Our financial advisor conducted an initial consultation with Sarah and James

- Loan Pre-Approval: Based on the information provided, we offered a loan pre-approval with competitive.

- Streamlined Application Process: We provided a simple and user-friendly online application process

- Quick Approval: Thanks to our efficient processing system, Sarah and James received loan approval within 48 hours.

- Personalized Support: Throughout the process, our dedicated customer service team was available

-

Client:

loardway Company -

Date:

17 March, 2023 -

Category:

Modern -

Time:

1 Year -

Share: